Mortgage Annual Percentage Rate (MAPR) Calculator

Mortgage Annual Percentage Rate (MAPR) Calculator

The Mortgage Annual Percentage Rate (MAPR) Calculator helps you understand the true cost of your mortgage. By inputting details such as your loan amount, interest rate, and any additional fees, this tool calculates the MAPR to provide a clearer picture of your annual loan expenses. This calculator ensures you make informed decisions by considering all costs associated with your mortgage.

| MORTGAGE APR CALCULATOR |

Understanding Mortgage Annual Percentage Rate (MAPR) with a Sample Calculation

When considering a mortgage, the Annual Percentage Rate (APR) is a crucial figure that represents the total cost of borrowing, inclusive of interest and other charges, expressed as a yearly rate. Unlike the basic interest rate, which may only reflect the cost to borrow the principal loan amount, the APR provides a more comprehensive view by incorporating fees and other costs associated with the mortgage. This makes it an invaluable tool for comparing different mortgage offers on a level playing field.

What is the Mortgage Annual Percentage Rate (MAPR)?

The Mortgage Annual Percentage Rate (MAPR) is an expression of the total cost of a mortgage loan, including interest rates, points, fees, and other charges, calculated as an annual rate. It is typically higher than the interest rate because it includes all costs associated with securing a mortgage. Understanding the MAPR can help borrowers assess the true cost of a loan.

Components of MAPR

MAPR typically includes the following costs:

– Interest Rate: The base cost of borrowing the principal loan amount.

– Loan Origination Fees: Charges from the lender for processing the loan.

– Pointsncludes costs like appraisal fees, credit report fees, and private mortgage insurance.

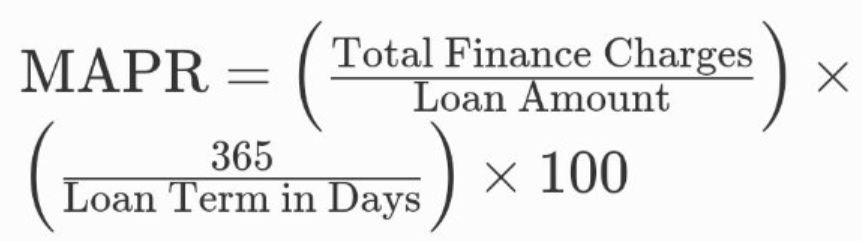

How to Calculate MAPR

Calculating the MAPR involves several steps to ensure that all costs are included in the calculation. Here’s a formula for a basic understanding:

MAPR = {(Total Finance Charges)/Loan Amount)x(365/Loan Term in Days)} x 100}

MAPR = {(Total Finance Charges)/Loan Amount)x(365/Loan Term in Days)} x 100}

**Total Finance Charges** include the interest, fees, and other related costs over the life of the loan.

Sample Situation: Calculating MAPR for a Mortgage

Suppose you are considering a $200,000 mortgage with a term of 30 years and an interest rate of 4%. Assume there are additional costs of $4,000 in points and fees.

Here’s how you would calculate the MAPR:

– Principal Loan Amount: $200,000

– Interest Rate: 4%

– Additional Costs: $4,000

– Total Loan Amount with Costs: $204,000

Steps:

1. Calculate the Total Interest Paid Over the Loan Term: For simplicity, use an amortization formula or calculator to find that the total interest paid at 4% over 30 years is approximately $143,739.

2. Total Costs of the Loan: Add the $4,000 in fees to the $143,739 in interest for a total of $147,739.

3. Calculate the MAPR:

MAPR = \left( \frac{147,739}{200,000} \right) \times \left( \frac{365}{10,950} \right) \times 100

\]

Simplifying the calculation provides an MAPR of about 4.32%.

Conclusion

The MAPR of 4.32% provides a more accurate picture of the cost of borrowing compared to the nominal interest rate of 4%. This figure helps potential borrowers understand the true cost of the loan, ensuring better financial planning and comparison